Q17. Which brands are you loyal to and why?

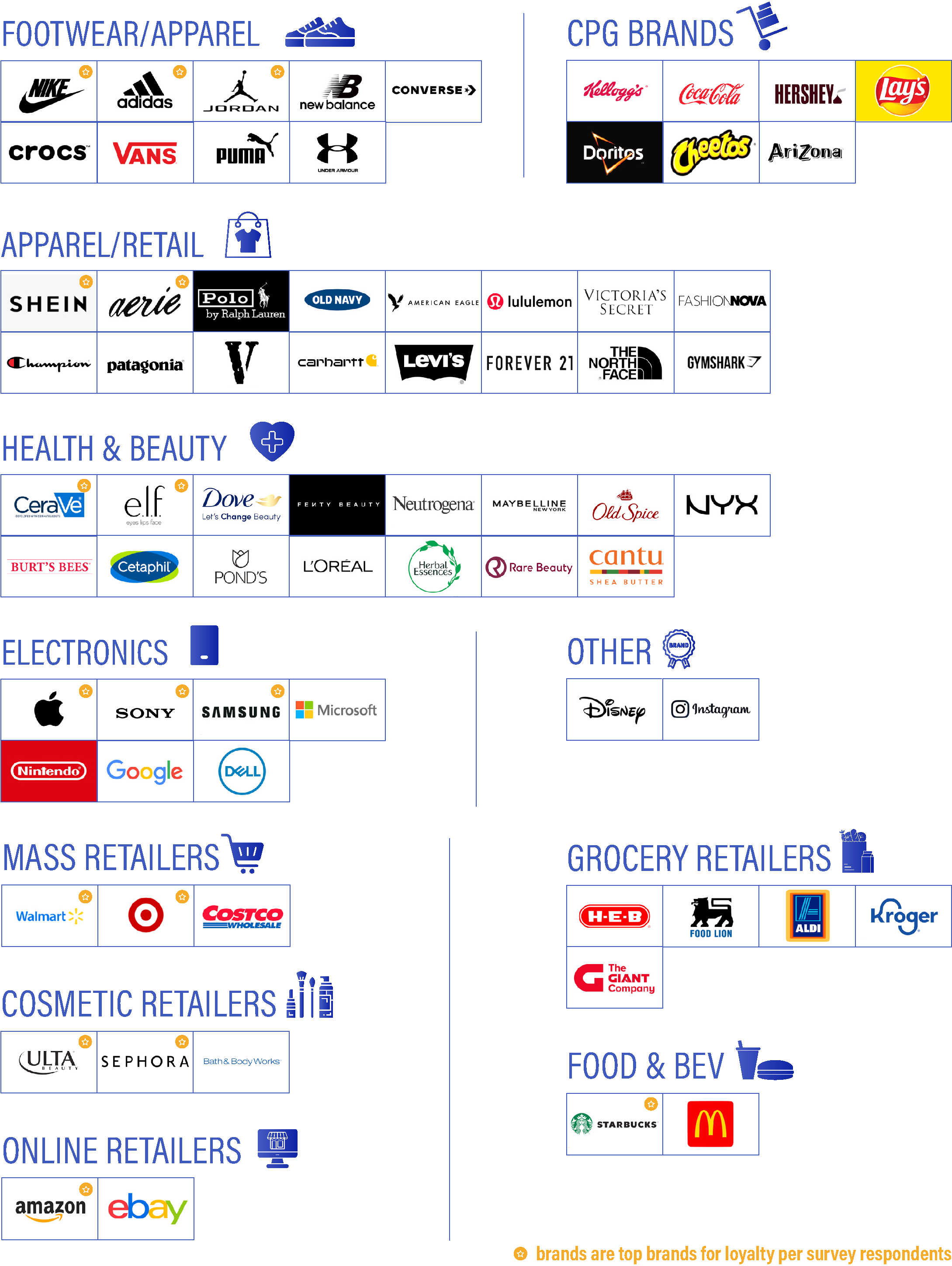

Nike was by far the most popular brand among the respondents representing 13% of all mentions followed by Walmart (5%), Amazon, apparel brand Shein, Apple (both 4%), Adidas (3%), Target, Jordan, apparel brand Aerie, skin care brand Cerave (all 2%), followed by a long list that included e.l.f. Cosmetics, Sony Ulta, Samsung and Starbucks.

Several grocery retailers including HEB, Giant, Kroger, Trader Joe’s, Food Lion, Costco, BJ’s and Aldi were mentioned and also respondents mentioned CPG brands including Kellogg’s, Coca-Cola, Hershey’s Doritos, Cheetos, Kraft, Amy’s Kitchen, Totino’s, Hidden Valley, Monster Energy, Kroger’s Simple Truth, and Walmart’s Great Value private label brand.

Other health and beauty brands mentioned included Cerave with the highest mentions (2%) e.l.f. Cosmetics (1%) Fenty Beauty, Neutrogena, Maybelline, Burt’s Bees, Cetaphil, Ponds, Dove, L’Oreal, Rare Beauty, Clinique, Aveeno and also beauty retailers Ulta, Bath & Body Works and Sephora.