-

https://www.washingtonpost.com/business/2022/01/07/covid-dogs-return-to-work/

-

https://news.samsung.com/uk/three-in-five-europeans-agree-pet-friendly-products-are-as-important-as-child-friendly

-

According to the 2023-2024 APPA National Pet Owners Survey

-

https://www.americanpetproducts.org/press_industrytrends.asp

-

Europe Pet Care (Food, Grooming, Accessories, & Healthcare) Market Outlook 2027: https://www.researchandmarkets.com/reports/5028329/europe-pet-care-food-grooming-accessories-and?

-

https://www.americanpetproducts.org/press_industrytrends.asp

-

https://www.entrepreneur.com/franchise/mans-best-friend-and-investment-the-thriving/430143

-

https://www.forbes.com/advisor/pet-insurance/survey-78-pet-owners-acquired-pets-during-pandemic/

-

https://www.statista.com/topics/3890/pet-market-in-europe/#dossier-chapter2

-

https://www.statista.com/statistics/453880/pet-population-europe-by-animal/

-

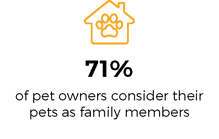

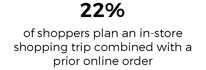

https://nielseniq.com/wp-content/uploads/sites/4/2022/06/Omnichannel-shoppers-drive-pet-category-growth.pdf

-

https://www.nasdaq.com/articles/pet-spending-by-generation%3A-millennials-are-most-likely-to-spoil-pets-with-lots-of-holiday

-

https://www.usnews.com/news/health-news/articles/2023-03-03/cats-dogs-part-of-the-family-for-most-american-pet-owners-poll

-

https://www.yahoo.com/lifestyle/behind-explosive-business-designer-pet-050130107.html

-

https://wwd.com/feature/designer-pet-accessories-luxury-prada-versace-1234991175/

-

https://p2pi.com/store-experience-evolving-pet-retail-concepts

-

https://www.petfoodprocessing.net/articles/14506-majority-of-pet-parents-willing-to-splurge-on-food-treats

-

https://www.statista.com/topics/1369/pet-food/#topicOverview

-

https://globalpetindustry.com/sites/default/files/2023-02/PIM_1_2023_FINAL%20%281%29.pdf

-

https://www.globenewswire.com/en/news-release/2022/05/05/2437177/0/en/Fuzzy-Redefining-Personalized-Pet-Care-Following-Surge-in-Company-Growth.html

-

https://www.hollywoodreporter.com/lifestyle/shopping/jonathan-van-ness-antoni-porowski-yummers-pet-brand-launch-1235250492/

-

https://www.americanpetproducts.org/press_releasedetail.asp?id=1267

-

https://www.morganstanley.com/ideas/pet-care-industry-outlook-2030

-

https://www.forbes.com/sites/forbesbusinesscouncil/2023/01/18/key-trends-that-will-transform-the-pet-health-industry-in-the-next-five-years/?sh=411977771e63

-

https://money.com/how-much-is-an-emergency-vet-visit/

-

https://www.bloomberg.com/news/articles/2023-03-24/pet-industry-outlook-is-strong-despite-rising-costs-of-food-vet-care?leadSource=uverify%20wall#xj4y7vzkg

-

https://naphia.org/industry-data/section-2-total-pets-insured/

-

https://www.forbes.com/sites/joanverdon/2023/03/22/petco-leans-into-fresh-food-trend-with-freshpet-partnership/?sh=13c5f9e6e53d

-

https://www.petfoodindustry.com/blogs/7-adventures-in-pet-food/post/9285-direct-to-consumer-next-big-opportunity-for-pet-food

-

https://time.com/6253164/pet-food-plant-based-animal-meat/

-

https://www.petage.com/3-financial-reasons-pet-businesses-should-embrace-sustainability/

-

https://nielseniq.com/global/en/insights/education/2023/2023-pet-trends/

-

https://www.marketingweek.com/mars-petcare-innovation-platforms/

-

https://vegconomist.com/food-and-beverage/pet-food/vegdog-secures-e3-5m-expansion/

-

https://www.petage.com/making-a-splash-pet-brands-discuss-todays-toy-trends-to-watch/

-

https://www.euromonitor.com/article/top-five-trends-in-pet-care

-

https://www.grandmalucys.com/pages/company-history

-

https://www.pureearthpets.com/

-

https://nielseniq.com/global/en/insights/education/2023/2023-pet-trends/

-

https://www.petproductnews.com/news/brick-and-mortar-is-the-next-frontier-for-dtc-pet-food-brands/article_13506134-b4f5-11ec-9b10-83205577f059.html

-

https://www.statista.com/statistics/1274160/pet-subscription-box-usage-by-generation-united-states/

-

https://www.entrepreneur.com/growing-a-business/4-ways-pet-care-industry-must-transform-its-marketing/440092

-

https://sproutsocial.com/insights/surprise-and-delight/

-

https://newscenter.purina.com/2022-08-23-Beggin-Hosts-Crowdsourcing-Campaign-to-Choose-the-Next-Dog-Treats-Flavor-Your-Dog-Will-Go-Bonkers-For

-

https://www.snipp.com/client/instagram-promotions-to-drive-engagement-for-champion-petfoods-acana?hsLang=en

-

https://shortyawards.com/14th/chewy-chatty-pets-hashtag-challenge-2

-

https://p2pi.com/purina-debuts-holiday-vending-machine

-

https://musebycl.io/health/people-return-office-petco-explores-pets-mental-health

-

https://www.petfoodindustry.com/articles/11754-spot-and-tango-helps-expand-the-fresh-pet-food-space?v=preview

-

https://www.justuno.com/blog/animal-pet-care-ecommerce-strategies/

-

https://www.modernretail.co/marketing/why-pet-brands-are-chasing-customer-loyalty-to-stay-recession-proof/

-

https://www.snipp.com/client/punch-card-loyalty-program-app-for-hagen?hsLang=en

-

https://globalpetindustry.com/sites/default/files/2023-02/PIM_1_2023_FINAL%20%281%29.pdf

-

https://nielseniq.com/wp-content/uploads/sites/4/2022/07/NielsenIQ-Q2-Pet-Trend-Reports-2022.pdf