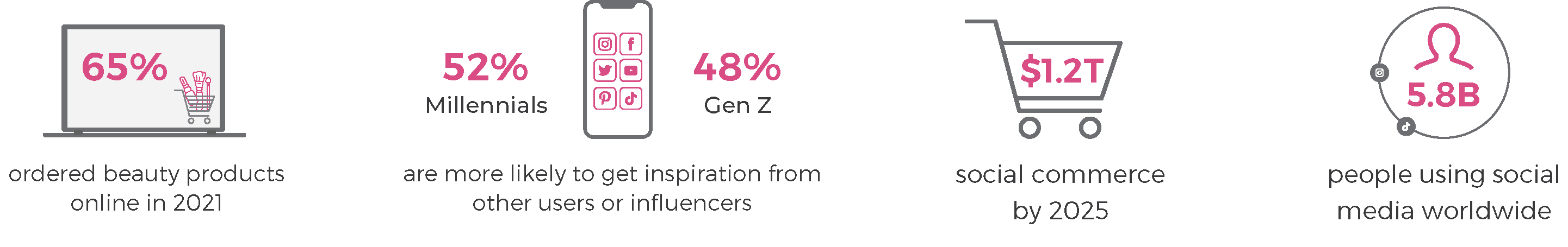

The beauty and cosmetics industry is seeing a renaissance, as consumers adjust to a hybrid work-life existence in this post pandemic era, but don’t expect makeup buying habits to return to what they were.

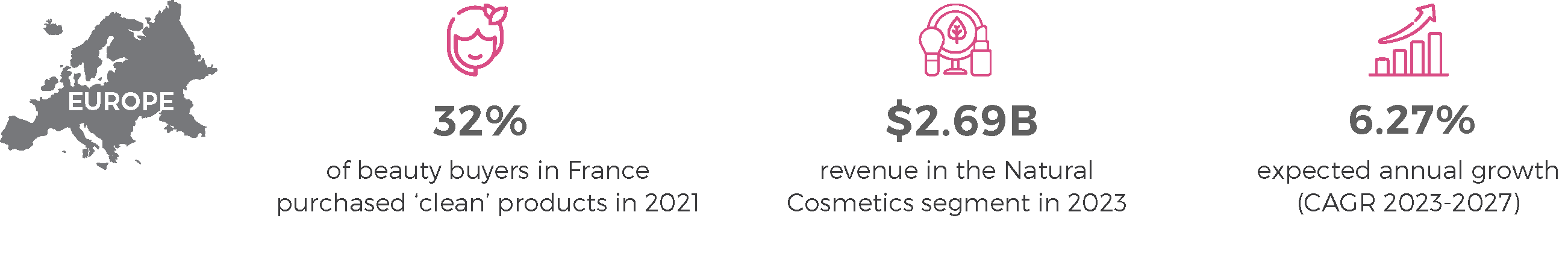

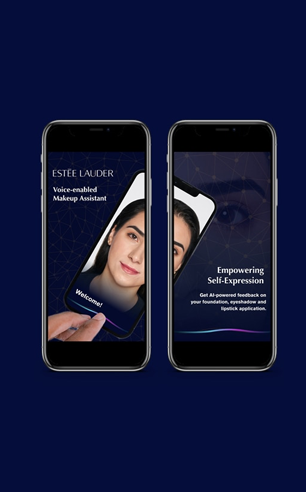

Aligning with the convenience of fast, low-maintenance looks adopted during the past couple of years, flexible and low-key beauty lifestyles are gaining prominence. Natural and vegan cosmetics also continue to grow in popularity as the world becomes more conscious of ingredients and their overall environmental impact. And with inflation surging, consumers are prioritizing fewer products that deliver more effective results, personalized to their preferences and needs. For brands, this translates into an expanded set of consumer expectations to be met, many of which will shape the landscape of the cosmetics and beauty industry.

In order to help our brand and agency partners navigate the year ahead, we’ve put together a primer on some key trends to watch out for in the cosmetics industry and offer up some strategies to contend with today’s changing consumer profile.